Monthly Average Balance of SBI - Details

Monthly Average Balance of SBI - Details

What is Monthly Average Balance (MAB)?

- Monthly Average Balance is often thought to be a fixed amount of money that is present in our bank account at all times.However, this notion is completely false.

- Monthly Average Balance can be defined as the total amount of money present in our account at the last day of the month divided by the total number of days of that particular month.

- It is to be noted that all the working days and holidays are to be included while calculating the total number of days of the month.

- Monthly Average Balance keeps varying from bank to bank and also based on the different type of accounts.

- So, before someone plans to deposit money in any bank He/She should check the details of the bank regarding the MAB policy that they follow and also for the types of account desired.

- Moreover it should be known that the Monthly Average Balance in Public sector Banks is much lesser compared to that of Private Sector Banks.

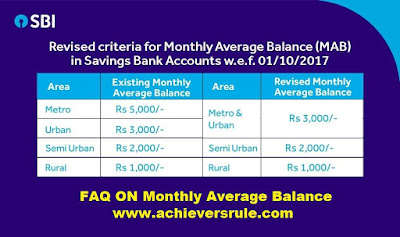

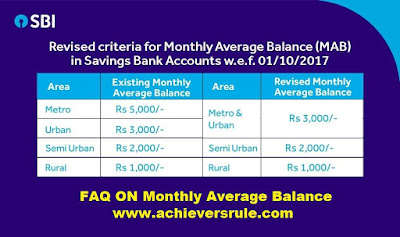

- State Bank of India has reviewed the MAB rates recently and the charges have been effective from 1st October 2017.

- It has been a long drawn problem that around 15 to 20 percent of account holders in SBI do not maintain the Monthly Average Balance properly.

- In April this year SBI had given a notice asking holders to maintain the MAB. But, even that was a failure.

- As a result around 230 Crore was recovered by the bank as a penalty.

- To prevent this SBI has come up with the revised policy and rules of the Monthly Average Balance.

- It is important to maintain the Monthly Average Balance because it provides greater security during economic downfalls.

According to the revised charges of SBI the following should be kept in mind.

- Failure to maintain MAB can result in a fine of Rs 100 in addition to the Goods and Services Tax.

- In case of metro cities if the balance falls below 75% of the MAB of Rs 5000 a charge of Rs 100 Plus GST will be fined .

- If there is a shortage of 50 % then the bank will charge Rs 50 plus GST.

What will be its Effect on SBI Account Holders?

- SBI has decided to keep the MAB rates same for Metro and Urban Cities.

- Initially the rate of MAB for Metro Cities was 5000 and that of Urban area was 3000.

- Now, both Urban and Metro Cities need to maintain 3000 only.

- The Semi-Urban and Rural branches are supposed to maintain 2000 and 1000 respectively.

- SBI has reduced the penalty for Monthly Average Balance ranges between 20-50 % and the range will be 30-50 INR for urban and metro centres while 20-40 INR for Semi-Urban and Rural Centres of SBI.

- Additionally, SBI has removed the charges of GST on revised penalty.

- SBI has declared that some of the following institutions will not have to maintain a monthly average balance.

- Financial Inclusion Accounts

- No Frill Accounts

- Salary Package Accounts

- Basic Savings Bank Deposit Account

- Small accounts

- Pehla Kadam Pehla Udaan Accounts

- Primary account Holder

- Pensioners of all categories

- Accounts under the Prime Minister’s Jan Dhan Yojana (PMJDY)

- Basic Savings Bank Deposit Accounts (BSBD

Click here to know more about SBI Merger with Five Associate Banks

Post a Comment